Home » News

MFPC is an independent body set up with the noble objective of promoting nationwide development and enhancement of the financial planning profession. MFPC provides an evolving set of Best Practice Standards and Code of Ethics that must be adhered to by Registered Financial Planner (RFP) and Shariah RFP designees.

Quick Links

Corporate Members

MFPC Penang Chapter

MFPC East Coast Chapter

MFPC Johor Chapter

MFPC Sarawak Chapter

MFPC Sabah Chapter

Individual Members

Certified MFPC Trainers

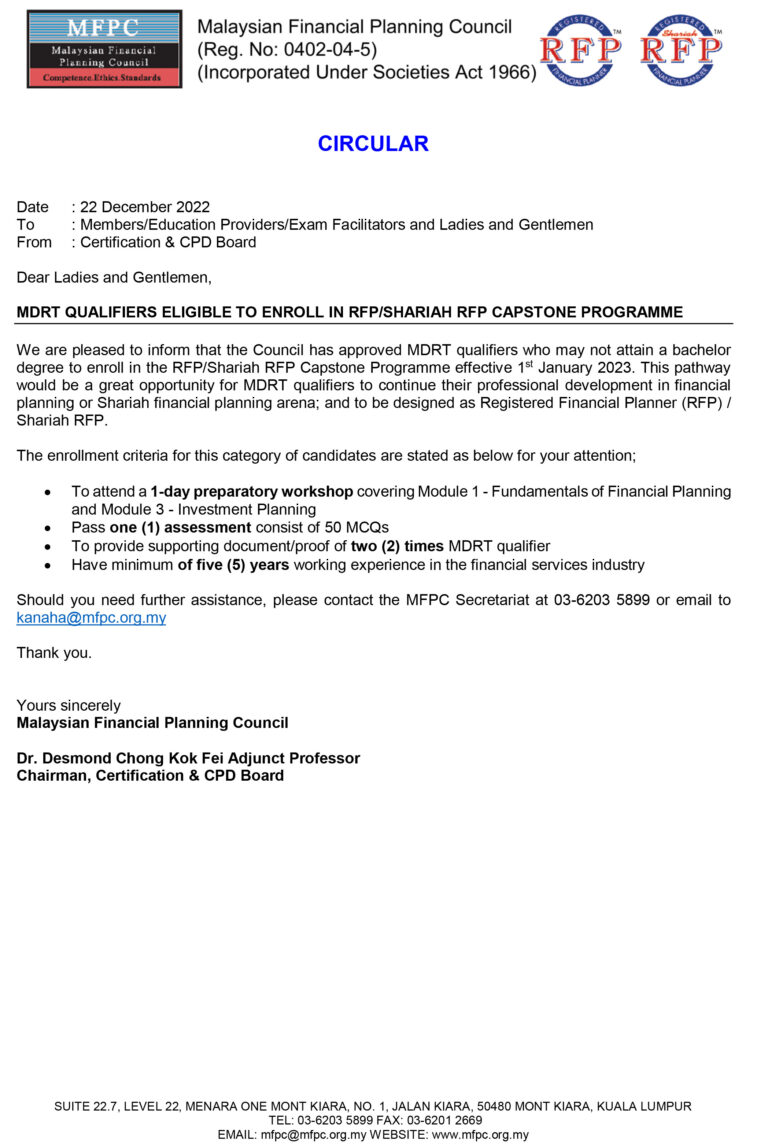

Registered Financial Planner (RFP) Capstone Programme

Shariah RFP Capstone Programme

CPD & Events

Examination

Circulars

Modular Exemption

Event Calendar

Registered Financial Planner (RFP)

Certificate of Proficiency in Financial Planning

Shariah Registered Financial Planner (Shariah RFP)

© 2025 Malaysian Financial Planning Council. All rights reserved.