Platinum Sponsor

Gold Sponsors

Silver Sponsor

Bronze Sponsors

Supporting Organisations

Online Registration

NON-MEMBER / PUBLIC REGISTRATION :

Please click below to register>> https://1st.mfpc.org.my/PublicEventRegistration/499

MEMBER REGISTRATION :

Please register via 1stMFPC Portal >> https://1st.mfpc.org.my

Introduction Event

Welcome to the 11th MFPC Conference on Shariah Wealth Management & Financial Planning, a vibrant celebration intertwined with the elegance of the MFPC’s 20th Anniversary. Embark on a journey with us for a day that promises to unveil the secrets of “Shariah Estate Planning: Preserving Wealth Across Generations.” Immerse yourself in captivating discussions with keynote speakers, industry trailblazers, and scholars, all while raising a toast to two decades of excellence with the Malaysian Financial Planning Council.

Dive into the heart of Shariah Wealth Management through engaging workshops, uncovering the art of preserving wealth across generations. Connect with a dynamic community of financial planners, wealth managers, Shariah advisors, and more during our lively networking sessions. Secure your front-row seat at https://www.mfpc.org.my/cpd-events/swmfp and explore sponsorship opportunities to adorn your brand amidst industry luminaries. Don’t miss this chance to revel in the magic of the 11th MFPC Conference—a vivacious celebration of 20 years of excellence with the Malaysian Financial Planning Council!

Event Objective

- Knowledge Exchange: Facilitate insightful discussions at the 11th MFPC Conference, addressing trends and challenges in Shariah finance for continuous professional development.

- Milestone Celebration: Commemorate MFPC’s 20th Anniversary Luncheon, reflecting on two decades of achievements and contributions to the financial planning landscape in Malaysia.

- Networking Hub: Provide a platform for industry leaders and practitioners to network and collaborate, fostering partnerships in the advancement of Islamic wealth management and financial planning practices.

Programme Background

Over the past decade, Malaysia’s financial services sector has rapidly expanded, notably in Shariah wealth management and financial planning, identified as a National Key Economic Area by the government. The Malaysian Financial Planning Council (MFPC) has been pivotal in driving growth and innovation in this dynamic landscape. At the core of this sector is Shariah-compliant financial planning, going beyond transactions to encompass ethical considerations related to wealth, financial duties, and obligations. This holistic approach aligns financial planning with Shariah principles, emphasizing ethical wealth stewardship and the intrinsic value of human life. From a Shariah perspective, wealth is seen as a divine creation, emphasizing the limited role of human effort in wealth creation through productive and investment endeavors.

Recognizing the potential unfamiliarity of the audience with Shariah studies, there is a concerted effort to present complex concepts in an accessible manner, with scholars actively simplifying the discourse. Despite the limited availability of dedicated courses on Shariah financial planning, the increasing market demand suggests a positive trajectory for future developments. Aligned with Malaysia’s vision to be an International Islamic Financial Centre, the MFPC is unwavering in its commitment, set to host the 11th Conference on Shariah Wealth Management & Financial Planning in 2024. This flagship event, in conjunction with the Malaysian Financial Planning Council’s 20th Anniversary Luncheon Ceremony, not only celebrates past achievements but also underscores dedication to advancing Shariah transactions and business practices. With anticipation for robust discussions contributing to national objectives, the MFPC remains a crucial driver of innovation and ethical practices in navigating the complexities of Shariah wealth management and financial planning, contributing to the continued success of Malaysia’s financial services sector.

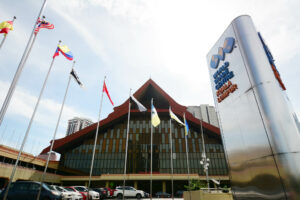

Venue Location

World Trade Centre Kuala Lumpur (WTC KL), a prominent site for international events and conferences, is situated in the center of the city’s dynamic business zone. Its strategic location, 41, Jalan Tun Ismail, Chow Kit, 50480 Kuala Lumpur, Malaysia, ensures seamless experiences in a bustling metropolitan setting and provides easy access for participants from all over the world.

Luncheon & Conference Information

Guest of Honour:

Dato’ Seri Dr Awang Adek Hussin

Chairman, Securities Commission Malaysia

Session 1:

Title: “Global Perspectives on Estate Planning: A Comparative Analysis of International Practices and Malaysia’s Achievements”

Discover how estate planning works worldwide and what Malaysia has achieved. Learn about different countries’ approaches and see how Malaysia stands out in managing wealth and planning for the future

Speaker Profile

YBHG. PROF ADJ. DATO’ AHMAD SARUJI ABDUL AZIZ

Chief Executive Officer & Managing Director, Amanah Warisan Berhad

Session 2:

Title: “Legacy Blueprint: Crafting Effective Strategies for Shariah Wealth Preservation.”

Providing a blueprint for individuals and families on crafting effective Islamic estate planning strategies to ensure the seamless preservation of wealth for future generations.

Speaker Profile

- FARAH DEBA BINTI MOHAMED SOFIAN

STEP Malaysia Branch Chairperson

Farah Deba Mohamed Sofian is an Advocate & Solicitor and a partner in her legal firm, Messrs Wong Lu Peen & Tunku Alina. Backed by 32 years of active legal practice, apart from corporate, commercial, real estate, banking, construction, infrastructural and intellectual property work, Farah’s current special focus is in the private wealth.

She currently heads the Inheritance and Succession Team providing a full range of inheritance & succession advisory services with special focus in asset protection & preservation, estate & business succession planning, probate & administration affecting Muslims & non-Muslims.

Farah is the current STEP Malaysia Branch Chairperson [STEP being the Society of Trust & Estate Practitioner a global professional body comprising of lawyers, trustees and other practitioners]. She offer her services to Muslim and non Muslim families, business and wealth owners across mutiple jurisdictions and generations plan for their futures. Her array of clientele are local Malaysians and foreigners of all walks of life. She attends to small estate matters and also serve high net worth individuals, trust companies, foundations (family holdings & charitable), professional will-writing companies & other body corporates.

Qualifications:

- Bachelor of Laws (Honors), International Islamic University Malaysia

- Masters of Laws from King’s College, University of London

- Advcate & solicitor the High Court of Malaya

- Mediator registered with the Bar Council Mediation Centre

- STEP Malaysia Branch Chairperson since 2016

- Trained Collaborative Law Practitioner

- Independent Non Executive Director of OSK Holdings Berhad

Forum’s Discussion Topic

Title: “Case Studies Corner: Learning from Successful Islamic Estate Plans.”

Presenting and discussing case studies of successful Islamic estate plans, allowing participants to analyse real-world examples and extract valuable insights.

Moderator:

MR NORFADELIZAN ABDUL RAHMAN

Panellist 1: Ms Irda Rina (TSI Wealth Planner)

Panellist 2: TBA

Panellist 3: TBA

Earlybird Rate (before 31 March 2023) MFPC Member : RM220.00 | Public : RM280.00

Standard Rate (before 15 April 2024) MFPC Member : RM250.00 | Public : RM320.00

Endorsement : MFPC 4CPD

Full Brochure in PDF>>Brochure 11th MECSWMFP 2024

Limited to 300 participants on first come first serve basis before : 5th May 2024

CONTACT PERSON

For Sponsorship

Mr. Azman

azman@mfpc.org.my

Tel: +603-6203 5899 ext270

For Registration

Ms Syahirah

ira@mfpc.org.my

Tel: +603-6203 5899

For Booth & Table Reservation

Ms. Yola

yola@mfpc.org.my

Tel: +603-6203 5899 ext230

En. Syauqi

Syauqi@mfpc.org.my

Tel: +603-6203 5899 ext271

MFPC welcoming you and your team to join us in our Shariah Wealth Management Conference and the 20th Anniversary luncheon on 16 May 2024 at the World Trade Centre.

- Opening an Information Booth: For RM2,000, you can open a booth at the conference venue. This package includes:

- Booth space in the exhibition area

- Opportunity to showcase your products/services to conference and luncheon attendees

- Operative networking opportunities

- Ensured your place was reserved: For RM2000, you can have a table for 10 people at the MFPC 20th Anniversary Luncheon. This package includes:

- Reserved table seating for 10 guests

- Pleasure-loving luncheon served during the event

- Guest of Honour’s Special Remarks (Bank Negara Malaysia)

- Witness the Launch of Basic Financial Planning Booklet

- Witness the MFPC Industry Excellent Awards Presentation

We believe you and team will gain tremendous exposure and beneficial networking chances during the event. It would be a pleasure if you could join us in commemorating this significant anniversary.

* Please note that Booth packages are subject to change and alteration at the discretion of the organizers.

NON-MEMBER / PUBLIC REGISTRATION :

Please click below to register>> https://1st.mfpc.org.my/PublicEventRegistration/499

MEMBER REGISTRATION :

Please register via 1stMFPC Portal >> https://1st.mfpc.org.my